Modernising BFSI: Overcoming legacy and embracing the future

Banking and Financial institutions grapple with an array of challenges, from legacy infrastructure and cybersecurity threats to regulatory compliance and inconsistent global operations. The pressure to meet rising customer expectations for seamless digital experiences is immense, while managing data explosion and ensuring operational resilience against disruption remains a constant struggle, prompting the BFSI industry to accelerate digital transformation.

Tomorrow's demands today: Is your IT infrastructure truly ready?

1

Legacy infrastructure & tech debt

Aging, fractured IT obstructs modernisation, restricts cloud integrations, and inflates upkeep expenses.

2

Evolving cyber risks & rules

BFSI faces rising cyber threats under complex rules, demanding intense security and compliance efforts.

3

Siloed global operations

Diverse regions, vendors and rules create inconsistent networks, hindering performance, inflating costs globally.

4

Ever-growing demand for digital experiences

Legacy systems and siloed service delivery models fail in delivering personalised, seamless experiences.

5

Disruption & operational resilience

Core banking outages can impact reputation and regulatory compliance. Many lack modern failover, resilient design, or live service views.

6

Demand for real-time insights

Flooded by data, BFSI firms struggle to capture, process, and analyse it real-time for fraud prevention, personalisation or strategy.

7

Combating high cost of ownership

Rising competition and tight margins pressure BFSI to cut costs. Complex, multi-vendor on-premise IT inflates TCO, hindering scale and innovation.

Partner with experts for a seamless transition

.jpg?width=2500&height=1875&name=shutterstock_2495795811%20(1).jpg)

Minimise financial and reputational risk. Enhance customer trust.

We offer real-time threat detection, transaction monitoring and AI-driven behavioral analytics to pinpoint anomalies and prevent fraud across all channels. Key use cases include securing digital banking, monitoring insider threats, automating regulatory reporting and detecting financial crimes like money laundering and phishing. Leveraging secure cloud platforms, zero-trust architecture, and data residency compliance, we ensure regulatory alignment across jurisdictions.

Governance, Risk and Compliance

Managed Detection and Response

Cloud Security

Network Security

.jpg?width=2500&height=1875&name=shutterstock_1443614873%20(1).jpg)

Faster onboarding, reduced customer churn, deeper engagement

Transform your customer experience at every touchpoint—onboarding, service delivery, and relationship management. Our cloud-based CPaaS and CCaaS solutions simplify communication across mobile, web, branches, contact centres, and social platforms. From AI-powered onboarding and secure video KYC to real-time issue resolution and tailored financial advice, we help you deliver seamless, impactful interactions.

Tata Communications Kaleyra Customer Interaction Suite

Tata Communications Kaleyra CPaaS

Tata Communications Kaleyra CCaaS

.jpg?width=2500&height=1875&name=shutterstock_2424031757%20(1).jpg)

Swift settlements, fewer failures and a seamless digital payment experience

Our global network reach, API-ready platforms and low-latency architecture supports real-time payment flows across UPI, NEFT, IMPS and cross-border remittances with intelligent routing, dynamic load balancing, and encryption for end-to-end security and compliance. Your customers enjoy instant confirmations, real-time tracking and timely alerts, all accessible through digital banking channels like mobile apps and SMS.

IZO™ Core Connectivity Private Line

IZO™ + Multi Cloud Connect

Tata Communications Vayu Financial Cloud

.jpg?width=2500&height=1875&name=shutterstock_1997387951%20(1).jpg)

Boost workforce productivity, fostering agility and innovation across your bank's ecosystem.

Your branch staff, remote teams, and knowledge workers can collaborate seamlessly with real-time communication tools, use secure virtual desktops for remote banking, and leverage AI-powered service desks for faster issue resolution. With advanced identity management, zero-trust security, and SD-WAN, you'll deliver a consistent employee experience, boost productivity, and drive operational agility across your organisation.

Tata Communications Kaleyra Unified Communications

IZO™+ SD-WAN

Security Service Edge

Zero Trust Network Access

.jpg?width=2500&height=1875&name=shutterstock_2288860573%20(1).jpg)

Reduce cost-to-serve, improve process cycles and agility

By combining intelligent networks, automation, and cloud-native platforms, you’ll simplify operations, break down silos, and cut costs. Centralise branch operations with SD-WAN, resolve service tickets faster using AI-driven ITSM, and move towards paperless workflows with e-signature integrations. With cloud-based document management, navigating regulatory processes becomes seamless and efficient.

.jpg?width=2500&height=1875&name=shutterstock_2142292985%20(1).jpg)

Transform your customers retail banking experiences

Cut long wait times, reduce costs and improve digital engagement with a seamless phygital experience across your customers’ in-branch journey. Attract, serve and retain customers more efficiently while gaining insights through actionable analytics from physical spaces. With secure, reliable edge connectivity and fully managed services from Tata Communications, we’ll ensure smooth implementation and operations every step of the way.

Tata Communications Vayu Edge

Tata Communications Vayu Financial Cloud

Tata Communications Kaleyra Customer Interaction Suite

Count on us for proven results

Case Study

Banca Widiba redefines banking with video communication

Case Study

Tally enables its users to perform GST related tasks seamlessly and efficiently

Case Study

Swift Transactions: Tata Communications Powers 500M+ PhonePe Users

Case Study

Bajaj Auto Credit Limited makes it simpler and faster for its customers to finance their favourite Bajaj vehicles

.png?width=125&height=70&name=images%20(1).png)

Case Study

Bharti AXA with 13% Network Improvement enhances Customer Experience

Johnson K Jose

Chief Information Officer, The Federal Bank Ltd.

Assured availability and price were key criteria in our choice of Tata Communications. In addition, we could opt for an infrastructure-as-a-service architecture to allay security and performance concerns.

Madhusudan Warrier

Chief Information Officer, NIIF Infrastructure Finance

After NIIF Infrastructure Finance Limited became a separate entity, it had to operate in compliance with the RBI regulations for NBFCs. This would include all IT regulatory aspects from infrastructure to operating systems. Tata Communications enabled us set up a secure cloud-based infrastructure that will effortlessly keep pace with technology trends.

A partner you can trust

Leader in the Gartner® Magic Quadrant™ for Global WAN Services, for the 12th year in a row

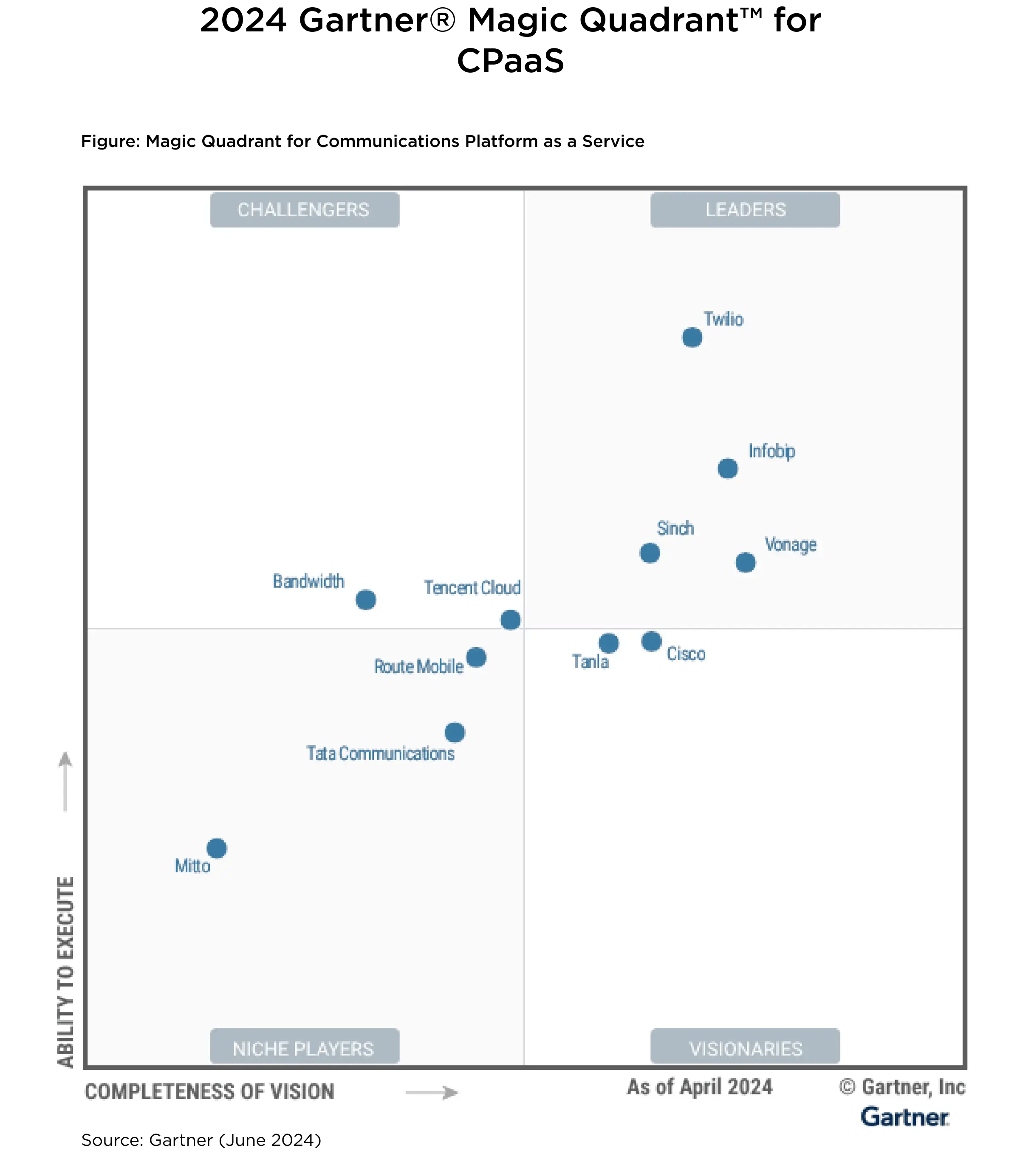

Recognised as a Niche Player in the 2024 Gartner® Magic Quadrant™ for CPaaS

Innovator in Avasant’s Advanced Network Services 2024 RadarView™.

Our latest resources

White Papers

Laying connectivity cornerstones to make BFSI enterprises more smart and secure

Discover how redefining WAN architecture with SD-WAN empowers financial institutions to build ...

White Papers

The Moment of Truth for your Digital-First Enterprise | BFSI Whitepaper | APAC

Discover how financial institutions in APAC can create secure, scalable digital ecosystems to ...

What’s next?

Experience our solutions

Engage with interactive demos, insightful surveys, and calculators to uncover how our solutions fit your needs.

Exclusively for you

Get exclusive insights on the Tata Communications Digital Fabric and other platforms and solutions.